Singaporeans would know that owning a car is not as easy as it sounds. It’s a universally-acknowledged truth that the price of owning a car in Singapore is hella expensive which is why some of us prefer to go the second-hand route.

And because it’s 2017, car dealers are almost a thing of the past – we’re now blessed with car marketplaces that allow the buying and selling online – providing ease and hassle. The number of direct owners trying to sell their cars on these marketplaces has been steadily increasing by at least 10 per cent each year, and now, even our local bank DBS has moved from providing loans for vehicles with the launch of DBS Car Marketplace.

A Strategic Partnership for DBS

Jeremy Soo, Head of Consumer Banking (Singapore) of DBS said, “DBS Car Marketplace exemplifies how we are reimagining banking, using digital technology and innovation to extend our reach. Our insights indicate that consumers increasingly value transparency and simplicity, particularly in large purchases such as cars. We’ve therefore designed the marketplace so buyers and sellers are seamlessly guided throughout their purchase or sales journey – from start till completion – and provided relevant financial and product information.”

With partners sgCarMart and Carro – both popular car sales online portals – this will be Singapore’s first and largest online consumer marketplace helmed by a bank. The partnership is not at all surprising seeing as how sgCarMart has the biggest database of new and used cars in Singapore while Carro has a 30-days guarantee for car sellers.

The portal will connect buyers and sellers, and aims to give them full control and transparency over every stage of the process. Sellers on the DBS Car Marketplace will get to list their vehicles on both sgCarMart and Carro for free until October 4.

DBS is also offering an online interest rate of 1.99% per annum (until August 31) on car loans when someone buys a car from their marketplace.

It’s also a one-stop shop for potential car owners, the marketplace functions such as an on-site car budget calculator provides the estimated loan amount the buyer is eligible for and then serves them a list of cars based on their budget. If buyers find a car they are interested in, they can arrange with the seller directly online for a test drive. Both parties will also be fully guided and entitled to free paperwork services for car ownership transfers.

If you’re wondering if it is at all legal, the new updated MAS framework allowed banks to engage in the operation of digital platforms that match buyers and sellers of consumer goods or services, as well as the online sale of such goods or services.

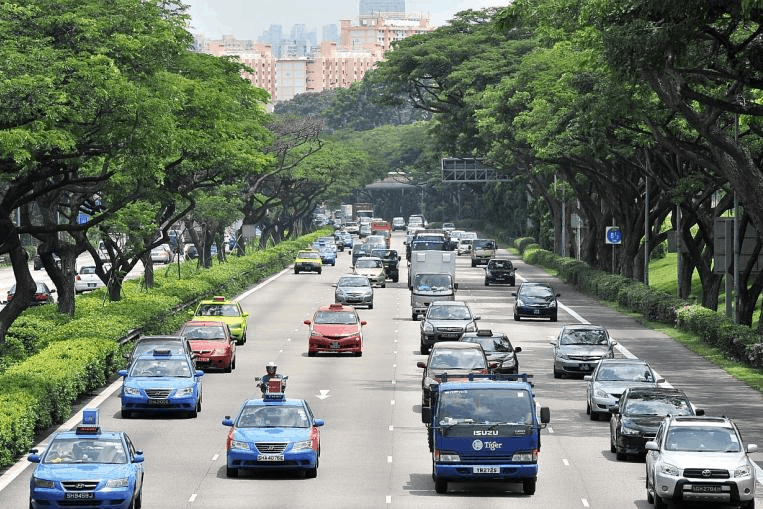

(Header image: Source)