Nowadays, the Taiwanese smartphone manufacturer is down to a mere fraction of its peak market share.

Hoping to turn their fortunes around, HTC is reportedly selling one of their manufacturing factories in Shanghai to a tune of US$91 million, with the proceeds being channeled into their fledgling virtual reality (VR) business. The Taiwanese tech company claims that the sale will not impact HTC’s ability to manufacture smartphones, as the sale would “fulfill the company’s operational adjustment needs and assets activation.”

Making The Sale

The company is no stranger to selling off properties to make ends meet. Previously, they sold another factory in Taoyuan City, Taiwan, for US$183 million in 2015.

There was a time when HTC was on top of the world, claiming the title of the original equipment manufacturer (OEM) with the largest market share in the United States. That was back in 2011. Six years ago, practically like an eon in the tech world. While their flagship devices continue to be adored by tech enthusiasts and reviewers, the purchasing public holds a different opinion, as evidenced by the HTC 10’s struggle to sell even a million units in 2016 despite glowing reviews. HTC’s latest offerings, the HTC U Ultra and U Play, have been received poorly and are not expected to give the company the profit boost they are hoping for.

HTC’s Operating Loss

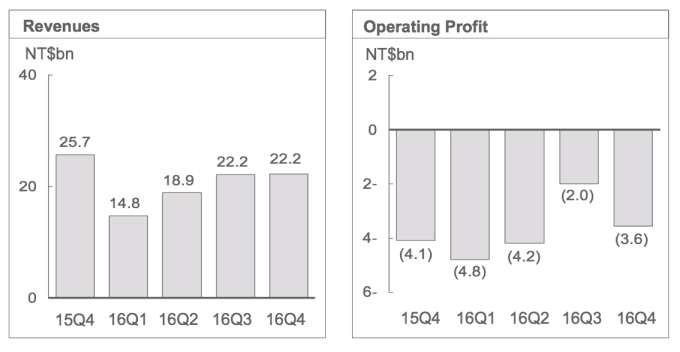

In its heyday, HTC was attributed with popularising many of the current smartphone conventions – a full metal unibody, dual cameras, and the earliest adoption of the Android operating system, to name a few. Nowadays, the Taiwanese smartphone manufacturer is down to a mere fraction of its peak market share, with their operating loss for Q4 2016 at NT$3.6 billion (US$116.8 million) – and that was an improvement year-on-year.

This operating loss, however, has become a norm for HTC. After their first ever report of a quarterly operating loss in Q3 2013, the company has been on a downward spiral ever since, with the total revenue of the company in 2016 being US$2.43 billion, a 35% fall from the previous year. Keep in mind that these numbers include HTC’s contract with Google to manufacture the Pixel and the Pixel XL, as well as profits from their VR division.

Tough Smartphone Market

Moreover, the company also recently announced that they would no longer be producing entry-level smartphones, a market where other smartphone manufacturers have been able to produce faster devices and sell them at lower prices. These phones, however, have been known to be loss leaders. Xiaomi’s former Global VP, even once said that Xiaomi “could sell 10 billion smartphones and [the company] wouldn’t make a single dime in profits.”

With that said, HTC’s place in the high-end smartphone market is also shaky at best. Its competitors have revenue coming in from larger divisions – LG with screens, Sony with cameras, Apple with home computing – allowing them to outspend HTC in the research and development, and advertising departments, effectively pushing out the former market leader.

Shift Into The VR Business

Over the years, HTC has tried their hardest to keep up with the big boys, but it seems as if the Taiwanese company has finally seen the writing on the wall. While their smartphone woes continue to hit them hard, HTC’s VR business seems to be making headway in the industry, and the company has taken notice, diving head first into the market.

It is estimated that 450,000 units of the HTC Vive VR headset were shipped in 2016. Keep in mind that, at US$800 per set, the HTC Vive is the costliest high-end VR headset currently on the market, with the Sony PlayStation VR and the Oculus Rift coming in at US$400 and US$600, respectively. Chia-lin Chang, the company’s President of Smartphone and Connected Devices, even confirmed that the company does “sell per-unit Vive at a profit.”

While VR devices did not hit it out of the park in 2016 as predicted, and mainstream adoption is still a few years away, it has been touted as an eventuality as costs start to come down and consumers gain a wider understanding of the devices. HTC’s head start and laser focus on VR, a market that has been projected to be worth US$30 billion by 2020, might just see the company through and help them avoid the misfortunes that befell Nokia and BlackBerry.