Buzzfeed is currently valued at US$1.7 billion and has been through half a dozen rounds of funding since 2008.

Rumour has it that BuzzFeed, the home of “5 things you didn’t know” listicles and perfectly timed food videos when you’re really hungry, is set to take a page from Snap’s playbook and go public in 2018, according to Axios.

The media company, a favourite of millennials everywhere, has been frequently mentioned as one of the most anticipated possible initial public offerings (IPO) by industry watchers, thanks to BuzzFeed founder Jonah Peretti’s regular comments about taking the company public eventually.

Buzzfeed is currently valued at US$1.7 billion and has been through half a dozen rounds of funding since 2008. They have raised upwards of US$446 million dollars, with NBCUniversal and Hearst Ventures amongst the investors.

Why Is BuzzFeed Going Public?

An IPO is no small feat for a company to take, especially for a media company that derives its revenue from advertising. The reason is simple, investors normally are not as taken to media companies as they are towards tech companies – like Facebook, Twitter, and Snap – as it is much harder to generate quick revenue growth.

However, BuzzFeed might be facing pressure from investors to go public so that they are able to achieve a return on investment in the media company. One possibility is that NBC Universal, which has invested US$400 million in the company, is looking to cash in on its venture. Interestingly enough, NBCUniversal was also a huge investor of Snap Inc. prior to their IPO.

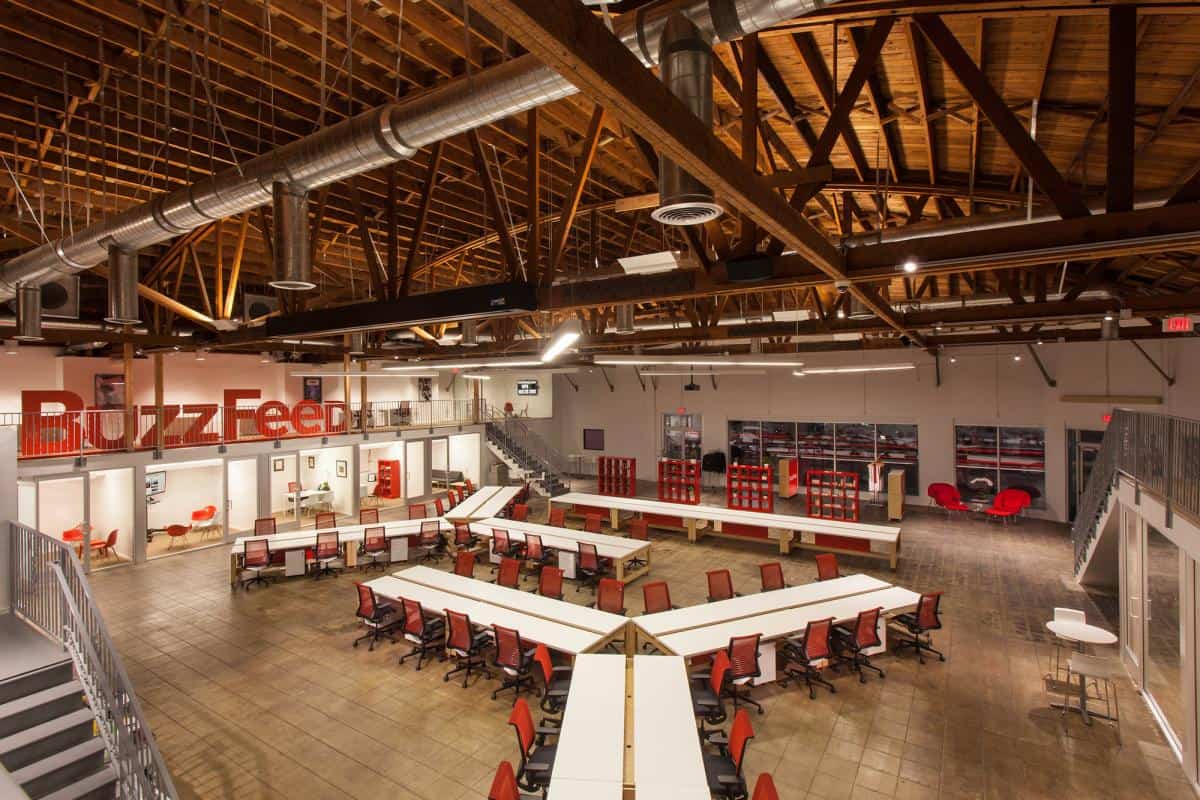

Another possible reason, according to Joseph Lu of Zacks Investment Research, could be BuzzFeed’s desire to expand. The media company, which has 18 offices and 1,300 employees across the world, could be looking to magnify their international reach with the influx of funds that the IPO would provide.

Also, BuzzFeed might also be toying with the idea of an IPO to establish independence from investors, as the company’s CEO Jonah Peretti has mentioned before. “[We] would like to continue to operate as an independent company, so that might mean a different kind of exit or cash out than selling to somebody,” said BuzzFeed Chairman Ken Lerer.

How Would It Turn Out?

If the potential IPO is carried out by BuzzFeed in 2018, there are signs to see how it would play out for them. For one, Snap’s recent IPO is a great example of how a highly anticipated IPO by a young social company would turn out – while Snap’s shares priced higher than market expectations, the stock has since started a steady decline, trading 10 percent lower than its initial opening price. Moreover, BuzzFeed’s valuation of US$1.7 billion has not seen the growth investors have expected since it’s 2015 round of funding, where it was valuated at US$1.5 billion.

Another area that could be a cause for concern would be BuzzFeed’s revenue. While Snap’s predicted revenue for the year of US$800 million is a whopping 160 percent growth from the previous year, BuzzFeed reportedly failed to hit revenue targets for 2016 and only managed to grow 65 percent. According to Fortune, BuzzFeed might have its reasons for going public “but its balance sheet and growth profile aren’t exactly a recipe for a blockbuster Snap-style share issue.”

Both BuzzFeed and NBCUniversal have refused to comment on these rumours, which leaves investors and market watchers to speculate on the possible IPO, and whether their viral sensation can turn its internet success into a full-fledged media company.