Oh Snap! They are losing a ton of money

With Snapchat officially filing their IPO, they have finally gone public with their financial information after years of secrecy.

Snap, the parent company of Snapchat, aims to go launch with a valuation of $20-25 billion. They hope to raise $3 billion with 15% of the company going public.

Now that they’ve finally released the juicy information that has been kept private all these years, here are 5 things you ned to know about what was released.

They Are Losing A Lot Of Money

It may not be surprising to some, but the figures still represent a sobering reality. In 2016, Snap Inc. had a loss of $514.6 million, grossly exceeding its revenue of $404.5 million. In 2015, losses were half of 2016, but their revenue also happened to be 6 times lower.

Many have tried comparing Snapchat to Facebook and Twitter. However, Facebook was already profitable when they launched their IPO in 2012.

Twitter on the other hand, went public in 2013, and were similarly making huge losses, though their revenue was at least more than that of its losses. Snap is definitely off to a rough-start and many question whether Snap will evolve to become profitable like Facebook, or struggle to recuperate their losses like Twitter until today.

Snap even mentioned in their filings that they “may never achieve or maintain profitability”, which is probably not the best sign.

Founders Will Still Retain Control Of The Company

Unlike most companies that have gone public, the two co-founders will control all stockholder decisions. They collectively own the majority of the voting stock, which might raise some risk concerns with future shareholders given such concentrated power decision power. Since they both each own 20% of Snap, if the valuation reaches $25 billion, their shares could be worth $5 billion each.

Spiegel, one of the co-founders, will reduce his salary to $1 per year with a $1 cash bonus. Both receive restricted stock units which will represent 3% of the capital stock.

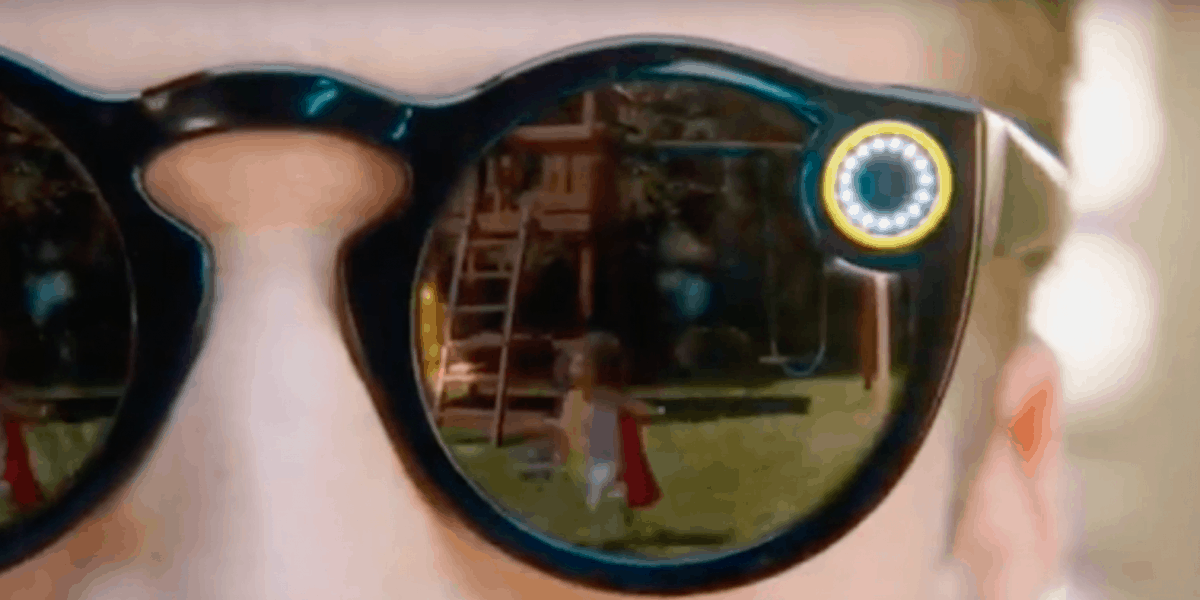

Venturing Into Hardware Has Not Paid-Off

Snapchat glasses seems like a big deal on the internet, but financially speaking, it has not helped their bottom line. 96% of Snap’s revenue still comes from advertising on their app.

There is a need to diversify the revenue streams, but Snap currently does not have enough “manufacturing experience” to scale efficiently.

Snapcash, which was launched back in 2014, has not been successful in generating buzz as well. Snapcash is a service that allows users to send money within the community using the app’s instant messaging feature.

Their Base is Mostly Made Up Of Young And Active Users

Majority of Snapchat users are 18-34 year olds. The age group under 25 also consists of hyperactive users, with more than 20 check-ins and more than 30 minutes of usage daily.

Snapchat has about 158 million daily active users, but the growth rate has clearly been slowing. They also noted in the filings that since teens form the biggest segment, they’re not particularly brand loyal and may turn to alternatives readily.

Risks With Over Reliance On Big Firms

Snap relies heavily on Alphabet Inc.’s Google Cloud to store their data, bandwidth and computing needs. Their dependence is significant, with utilization of their unlimited supercomputing software worth at least $400 million annually for the next 5 years. This puts Snap Inc. in a risky position if the deal were to be cancelled, further pushing up their costs and causing just too many disruptions.

Competition Is Tough

Snapchat has already begun competing with Instagram, especially with the launch of Instagram’s live feed and “Insta Stories” feature. In fact, since the launch of Instagram Stories, their growth has slowed by 82%. They mentioned potential competitive threats in their filings, but in this case, it’s pretty clear what they’re referring to.

Despite seeing themselves as “a camera company”, Snap Inc. does not consider any of the “camera companies” like GoPro to be tough competition with their own IPO gaining little traction.

In a nutshell, Snap faces competition from all the different arenas.

Looking Forward

Whether Snapchat is going to end up as a Facebook success story or a Twitter survival story will depend on how the market reacts to their valuation. With the new wave of major tech IPOs and deals that will saturate the market, Snap Inc. will have to constantly innovate and move beyond their quirky filters to expand their reach into other domains, just as Zuckerberg has done.

Kathleen Smith, principal of Renaissance Capital (IPO Firm) have reflected that much interest in Snap Inc’s IPO progression given the largely youth-targeted demographic. The success of Facebook could be attributed ultimately to being able to get everyone on the Facebook wall.