And it’s not solely because of the copycats.

Only a couple of months ago Snapchat’s IPO was the talk of the town, smashing expectations and outperforming competitors. However, last week the company released its first post-IPO earning reports, and things are not looking pretty for the social media platform – in fact, shares of Snap Inc. plunged 23 percent on Wednesday (10 May) when they released their earnings report. Although things picked up by Friday, closing at 17 percent down from Wednesday’s opening, it’s obvious that the tech darling needs to make changes, and fast.

Earnings Report

On 10 May, Snap released its earnings report – the company saw a loss of US$2.2 billion in its first quarter as a publicly traded company, growth slowed year-on-year to 8 million new daily active users for the quarter, and its foray into electronics via Spectacles has more than fizzled out.

While the company’s strategy of keeping its Spectacles a limited product (at least initially, it’s now available for purchase online) gave it bragging rights for long, snaking queues, but it also made for anemic sales. Snap made US$12.5 million from their Spectacles at $130 a pair, it works out to only 96,000 in sales – that’s less than 0.1 percent of all Snapchat users.

Moreover, the company keeps hemorrhaging money. While a majority of the US$2.2 billion loss is from stock payouts, Snapchat spends a lot more than the US$150 million in revenue it earned in the first quarter: spending US$99 million on cloud services, US$196 on operating expenses, and another US$78 million on research and development. Although the app has never been profitable before, Snap also told investors that it “may never achieve or maintain profitability.”

The Imitation Game

In the app’s early days, it blossomed due to its unique selling point of disappearing messages and 24-hour video feeds. As time went on, and as copycats came into the market, Snapchat’s distinctive different disappeared, and with that so did its competitive edge.

Snapchat is aware of Facebook’s mimicking act – which added Snapchat-like features across the company’s three major apps, Facebook, Instagram, and Whatsapp – and it seems as if they are unsure of what to do. Snap Inc’s CEO Evan Spiegel said that “you got to get comfortable with the fact that people are going to copy you if you make great stuff.” He went on to tout the company’s strategy of “creativity” to grow the app organically. Investors, however, seem to not have bought it, instead noting that Instagram Stories has leapfrogged Snapchat’s number of daily active users in a matter of months.

Twitter: Part 2

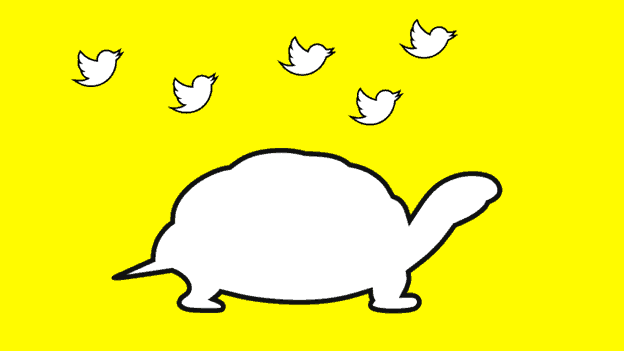

On the heels of their disappointing earnings report, many jumped to compare Snap Inc to Twitter: both had strong IPO debuts, only to fizzle out due to their struggles to show a growing user base. However, there are several key differences between the two social media platforms, differences which spell trouble for Snapchat than Twitter.

Unlike Twitter, which is without a direct competitor, Snapchat has Facebook breathing down its neck, guns blazing. Moreover, Snapchat as a platform doesn’t create lasting content (they literally disappear), giving users less of a reason to stay loyal to the platform. However, the company did add more users than Twitter year-on-year (44 million vs 18 million).

While Snapchat is still young, all cries of doom are still a bit premature and the company has a lot of ground to cover to regain investor confidence. Snapchat, however, seems to have a glimpse of a way forward for its future. The company recognized its lack of resonance with Android users, which make up 88 percent of all smartphones, and are working to turn these numbers around. Perhaps with Android users in their pocket, Snapchat can begin a turnaround process that might help it avoid the same fate that has plagued Twitter for the past years.