It’s never too early or late to start managing your finances. Avoid splurging on unnecessary items, and in time you will realise that you’ve become a happier person, because you only spend on what you need, things that you truly enjoy and make full use of.

Here are some 6 simple ways you can start managing your finances like a grown-up adult that you are.

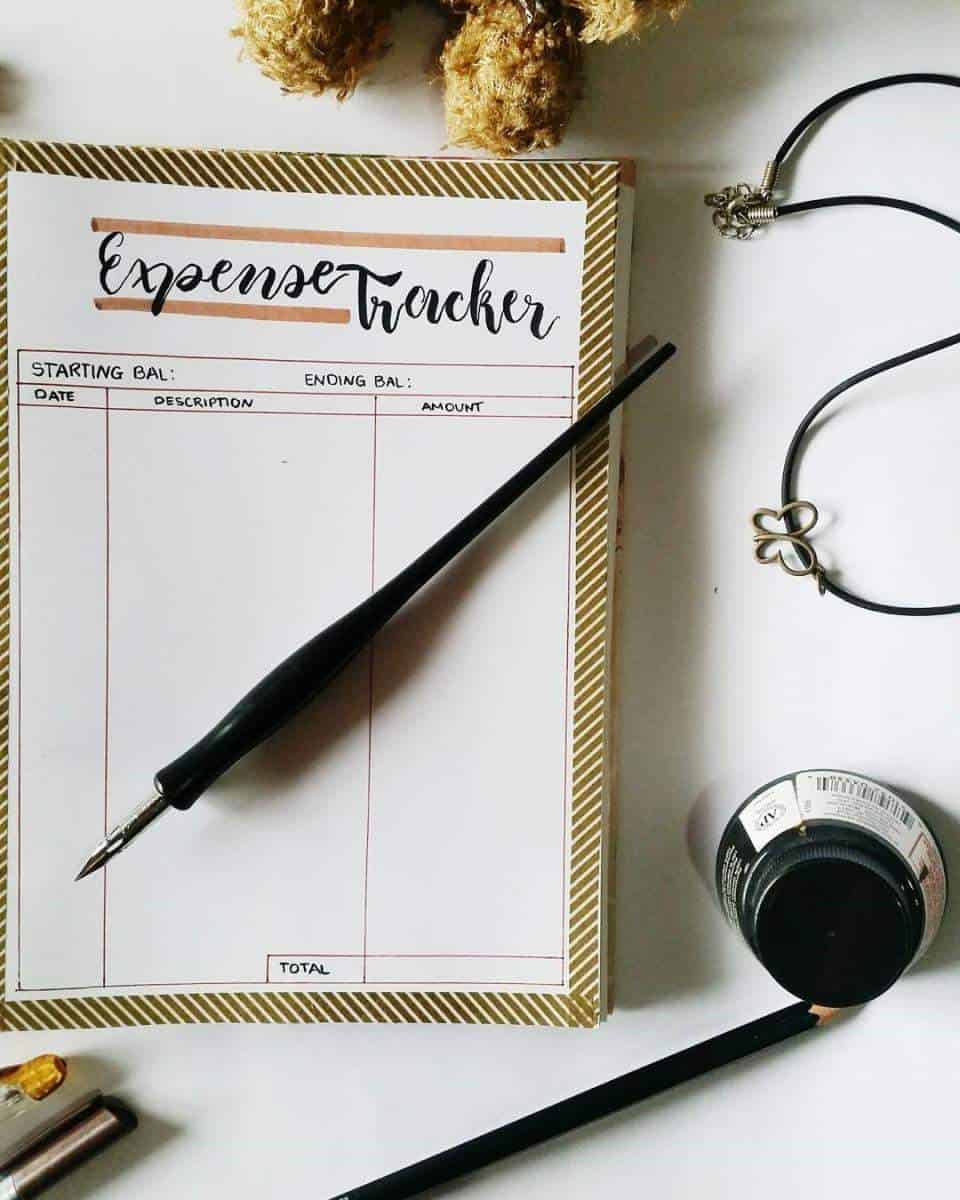

1. Track Your Expenses

The first step, also the most important one, is to keep a record of your expenditure. Be it jotting down in a notebook or using an expense tracking app to do so, this is a good habit that you ought to incorporate into your daily life.

This is especially applicable to those who have new to the workforce, who may find themselves feeling uncertain about managing the sudden influx of money, as compared to before. By tracking your expenses, you will have a greater awareness of your spending habits, such as how much you spend on different areas (food, shopping, transport etc), and therefore be able to manage your expenditure more efficiently.

2. Own Separate Bank Accounts

If you can, try to dedicate a bank account specific to saving, and another for your monthly expenditure. Also, set a budget for your monthly expenditure, which you can then divide between your cash on hand and within the account (which you can access via a debit card).

By limiting yourself to a budget, you are exerting greater control over your money, as you are more likely to think twice each time before you spend. Of course, the effectiveness of this method depends on your willpower in keeping your hands away from the savings account. If you know you are not the best when it comes to self-control, consider getting a trusted individual, such as a parent/sibling, to help oversee your savings account.

3 . Stop Impulsive Buying

Have you ever found yourself wondering why you tend to end up with a clutter of things which you’ve barely used, but end up having to chuck because they’re just collecting dust? Be it gimmicky gadgets, skincare products, clothes, shoes, or other miscellaneous items – how often do you actually use the things that you own? If you answer “rarely” or “I don’t remember/know” for way too many items, you might just be an impulsive buyer.

Ask yourself: Why did you impulsively spend on these items? Was it a form of escapism? Do you derive some sort of satisfaction from buying things? Do buying certain things make you feel better about yourself in some way?

In an interview with “TIME”, writer Geneen Roth said, “In the same way that we use food for emotional reasons, we use buying things to fill something that we can’t quite name.”

Most of us would find ourselves agreeing with this statement – which is no surprise – given the increasingly consumerist societies we find ourselves living within today. Progressively, we observe the escalation of the “Diderot effect”, a social phenomenon in which goods constitute the consumer’s sense of identity, and pave way for subsequent purchases of goods of a complementary nature. Say, you bought a TopShop top because it makes you feel better in front of your colleagues, but now you want a new bottom to go with it, and maybe new shoes to complete the outfit. This is known as the consumption spiral and it’s a vicious cycle indeed.

Now the question is, how should one go about dealing with this issue? The solution, though easier said than done, is to practice convincing yourself to start buying things for their usefulness, rather than the social status which you think they can bring you. Remind yourself to not let your possessions define you, to not let materialism corrode your sense of identity.

Your happiness, self-worth, and level of success are not attached to the material goods that you own. As mentioned, this is no easy feat. But we ultimately have to start somewhere, don’t we?

Another helpful tip is to keep a running list of things that you want to buy, which serves as a constant reminder of what you should prioritise in your spending – which are your “needs” over your “wants”. When you take the time to ponder over whether something is a necessity or a desire, you are subconsciously training yourself to become a more rational decision-maker. Additionally, always try to buy something that will complement what you already have (eg. clothes that go well with your current wardrobe).

4. The “Five Second Rule”

When you find yourself gravitating towards an item on the shelf, use the “Five Second Rule”.

5, 4, 3, 2, 1.

Take five seconds to walk away, and ask yourself if the item of your desire is really that essential to your life. The key to stopping impulsive purchases is to have the determination to walk away and delay that purchase. If you decide that you really need it, you can always return to buy it later. At least you will know then, that you made a rational decision.

If you would like to take it a step further, you can save the money that you would have spent on impulsive buys in a box/container. At the end of the month, you can review how much you have saved from curbing mindless splurges. You’d be surprised!

5. Set Long-term Financial Goals

There is a famous “Marshmallow test” that many parents try with their children (in variations), whereby children are present with a single food item, and told that they have two options when the adult leaves the room: 1) to consume the single food item immediately, or 2) to wait for a certain amount of time for the adult’s return, and be rewarded with two food items instead.

This simple test teaches an important lesson on self-control and delayed gratification, which is pivotal to mindful spending. The analogy fits in a financial situation: rather than giving in to short-term or instant gratifications, one should practice self-control and limit one’s spending to save up, to fulfill long-term, larger financial goals (eg. overseas trip, purchase of an HDB flat) instead.

For example, you might spend around $200 on shopping every month to “treat yourself”, which would amount to $2400 a year – and this amount can easily fund a 5-day trip to Taiwan or Korea. Even by reducing the amount to $100 monthly, you still save up to $1200 a year, which is more than enough for a short weekend getaway!

6. The “Pick 3″ Rule: The Keyword is “Limiting”, Not “Eliminating”

Spending mindfully entails spending wisely, not cutting down on all expenses. Since the main idea is to reduce excessive spending, you should allow yourself to give in (adequately) to three spending habits that confer you the greatest joy and pleasure.

Take for instance, music. If spending $9.90/month on Spotify Premium would make daily commuting more enjoyable, help you destress, and create great singalong sessions during a weekend hangout with your friends, I think it is a worthy investment. Think about it, you can easily save $9.90 (or more) by choosing to eat at home instead of eating out or having takeaway for a week, or by making your own coffee instead of getting an Americano or a latte from Starbucks daily. It’s not that hard!