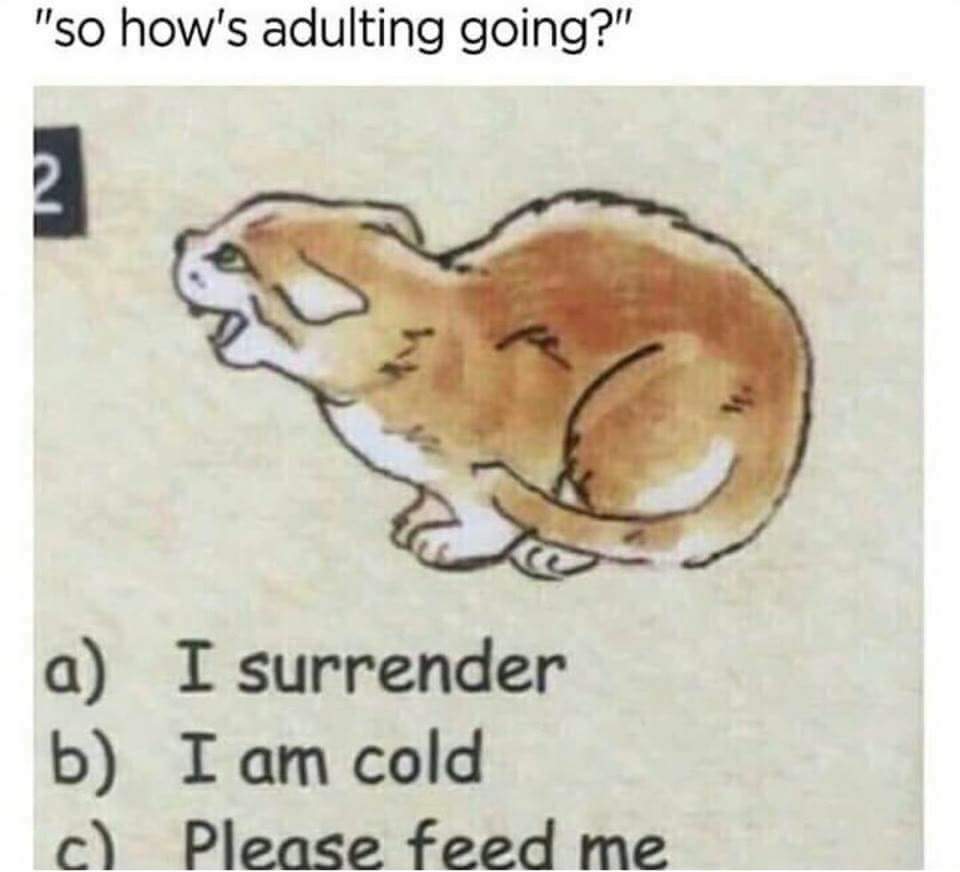

As much as youths these days dread ‘adulting’ – the daily tasks that our parents and grandparents perform effortlessly, it’s an eventually rewarding rite of passage that everyone has to undergo. Part of adulting is signing up for your first credit card, which will lead to many more down the road especially if you’re financially savvy and meticulous with your spending.

If that previous sentence caused you to doubt my sanity and intelligence, I implore you to read on.

Despite their bad reputation due to the sheer amount of options available – even Apple recently launched their own credit card – and news reports and anecdotes regarding misuse, credit cards are an important tool for generating incredible value out of your daily expenditure and building a reputable credit score.

For those of you wanting to settle down quickly – especially if your starting salary allows it – the latter point is something you should be paying attention to due to the loans that you will be taking, be it for your home, car or postgraduate education.

First Things First

Credit score concerns aside, what you should know before applying for a credit card would be whether you’re eligible for one in the first place.

Firstly, you do not need an account with a particular bank before applying for any one of their credit cards.

Secondly, you need a minimum annual income of S$30,000 a year but that is an arbitrary amount set by the Monetary Authority of Singapore.

Don’t be surprised if your application is approved by the bank even though your salary does not meet that requirement. Lastly, you need to be at least 21 years old to be a principal cardholder.

Although being a supplementary cardholder requires you to be only 18 years old, you would like to earn your own cashback and miles, wouldn’t you?

Cashback or Miles?

Whenever the topic of credit cards is brought up at the office’s water cooler, over dinner with your family or drinks with your friends, it’ll be followed with a discussion regarding cashback or miles 99% of the time.

The other 1% would be that guy in the group immediately jumping in to ‘educate’ his friends and relatives on how these disgusting things ruin lives and families – but he’s a problem for another article.

For the uninitiated, cashback and miles are the two ways that banks reward you for using their cards.

For cashback cards, you are rewarded with cash rebates for your daily expenditure or when you make purchases in specific spending categories like groceries or petrol, depending on the card.

Simple, right?

For ‘miles’ cards, it’s a bit more complicated because you’re actually given points for the bank’s rewards program in most cases. You can exchange these for shopping vouchers, frequent flyer program miles and movie tickets, among other things.

However, frequent flyer program miles represent much better value compared to the rest of the rewards that the banks put out, and that’s even if you redeem Economy class tickets solely.

Unfortunately, there are a dizzying number of cards available for both cashback and miles.

There are cashback cards that do not place a cap on the amount of cashback that you can earn per month and there are those that grant you bonus cashback on specific spending categories.

It’s a similar situation for miles cards. Some reward you with more points in specific spending categories while others have better benefits like limousine services or more free visits to airport lounges.

It’s important to think about which reward type would represent better value for you before looking through the many cards that are out there.

Is cold, hard cash more rewarding than frequent flyer program miles? That’s entirely up to you.

Money, Money, Money

For cashback cards, the caveats you need to take note of when sifting through a particular card’s terms and conditions would be the monthly cashback cap, minimum spend you need to hit (if any) and the spending categories that grant you bonus cashback.

Sign up for a card that grants the highest cashback percentage on things you spend the most money on in a month and you should be fine.

Cashback cards are a no-fuss, no-muss solution and if used correctly, ensure that your credit card fee for the year is paid for well in advance at the very least. If you take the time to request for a fee waiver, enjoy that extra free money you now have.

Cashback fanatics argue that cash is worth more than miles due to the flexibility that is granted along with the lack of an arbitrary value placed on the money you have on hand.

This is especially true if you aren’t a fan of travelling in the first place or are willing to slum it out in low-cost carriers or Economy class when you do fly.

The money you have could be put to better use like treating your friends or family to a nice meal or offsetting your monthly bills. However, value is highly subjective as you’ll see in the section on miles cards below.

Spoiler alert: Having almost permanent access to Business Class does not necessarily equate to happiness.

And I Would Walk 500 Miles

For miles cards, the caveat here would be that you need to be extra meticulous with your spending. Generating the maximum number of miles for each dollar you spend is arguably an occupation in itself, requiring you to sign up for multiple cards that serve a specific purpose each.

Shopping online? Just remember that card’s number, CVV/CVC and date of expiry and you’re fine.

Eating out tonight? Pray that you have your dining card with you.

Making overseas transactions? Say bonjour to your third card.

See where I’m going with this? If you aren’t that meticulous with your spending or think you’ll be best friends with the First Class cabin by using a single card, please head to the nearest bank now and sign up for the first cashback card you see.

The second problem for miles cards would be the arbitrary value that’s placed on frequent flyer program miles. You’re at the mercy of the airlines and should they devalue their own miles to make flight redemptions harder – which they have been doing with increasing frequency – tough luck.

However, miles cards grant the Average Joe aspirational travel opportunities, especially when they’re played right.

Pay the annual card fee for two basic miles cards, make a few purchases here and there and you’ll receive a ‘free’ one-way Business Class flight to anywhere in Southeast Asia on Singapore Airlines in return.

Imagine what you could do if you optimised your spending and took advantage of the many sign-up bonuses that are out there.

Hey, Wait A Minute…

If you’re wondering why I haven’t mentioned even a single credit card by this point, it’s due to how different everyone’s spending habits are.

For the miles chasers, there are cases where people forgo the ubiquitous general spending cards and perhaps jump straight into a card optimised for online shopping because someone else at home handles all the daily expenses instead.

For the cashback folks, they might not need cashback on every spending category or even an unlimited cashback cap if the bonus cashback on certain spending categories is good enough for them.

It’s up to you to decide which cards work best for you. If you already track your monthly expenses down to a t, things have just gotten a lot easier.

Take Note, Kids Adults!

As obvious as this sounds, remember to pay off your monthly credit card bills in full. The interest rates are not worth it, contrary to what you might be thinking. If you’re too lazy or are too busy negotiating with Russian oligarchs for your next big paycheck, there’s the little-known option to set up a GIRO arrangement for your credit card bills.

It’s a painless process that can be completed online in less time than brewing that morning cup of coffee.

Unfortunately, that doesn’t give you free rein to spend till the creditors come home. As mentioned earlier, credit cards are just a way to generate incredible value out of your daily expenditure.

You do not change your spending habits wildly, unless you have a big-ticket purchase to make and it so happens that a certain bank’s card is running an attractive offer that requires a minimum spend in the thousands. But see how specific that situation is?

Last but not least, please don’t be dragged into a proxy war with your newly-minted adult friends by comparing the size of your cards. Just because they can afford to sign up for that swanky $80,000 annual income requirement card right off the bat doesn’t mean that they’re able to make better use of it, or that the benefits are even better at all.

Like I said, this is an individualised process and something that’s entirely up to you to decide.

Who knew that credit cards could be so philosophical?