These startup ideas have received massive funding in china. but just how practical are they?

Disruptive innovations are those that create new markets and value networks which eventually disrupt existing market leaders, products, and alliances. As we have observed in the month of March, the Beijing-based bicycle sharing company Ofo kickstarted a rat-race upon their entry into the Singapore market, spurring its Singapore-based competitor oBike and Beijing-based competitor Mobike to scale their operations in Singapore exponentially.

In fact, these bicycle-sharing companies scaled so quickly that within just 2 days of MoBike’s entry into the Singapore market, the Singapore government decided to put its elaborate Nationwide Bicycle-Sharing Scheme to a halt.

In Singapore, the sharing-economy ecosystem is dynamic, overly-communicated and highly-competitive. What may seem conventional may just turn obsolete overnight, such as Uber and Grab disrupting ComfortDelgro, and Ofo disrupting the many local bicycle-rental companies we Singaporeans are so familiar with.

That said, some startups in China are receiving ridiculous funding for several bizarre sharing apps and here is an intriguing list of these startups.

Umbrella-Sharing

Umbrella-sharing companies such as Molisan and Hujie Web are allowing individuals to rent out umbrellas and return them afterwards, in the same way that bicycle-sharing services work. Shanghai-based Molisan has already begun trial runs in Guangzhou and Fuzhou this month, where for a deposit of RMB 20 and a daily fee of RMB 2 (payable via WeChat), Molisan’s bright orange umbrellas are for yours to rent by simply scanning a QR code attached to the docking station where the umbrella is locked.

At least six stations on the Guangzhou metro have adopted Molisan’s scheme and it is expected to further provide between 500,000 to one million umbrellas in Guangzhou this year. A late penalty of RMB 0.5 per day will be imposed after the initial rental period of 15 days.

Umbrella-sharing could be a thing in Singapore, where we experience sudden episodes of intense rainfall from time to time. Having these umbrella-sharing stations at our MRT stations could prove helpful to our densely-populated demographic and having to do without our portable umbrellas can surely lighten our daily bag load.

Basketball-Sharing

Zhejiang-based Zhulegeqiu runs a basketball-sharing service as a mini app in WeChat (China’s largest messenger app), allowing university students to rent a basketball for RMB 1.50 in 30 minute intervals. Users must go to the Zhulegeqiu app on WeChat and scan the QR code placed on the docking station to rent a basketball. Payment works the same way for Umbrella-sharing, where it is done via-WeChat which many users consider more convenient and safe.

Moving forward, Zhulegeqiu is expected to expand its services to 23 other cities in China. Although basketball-sharing does allow you to play ball without having to carry your own basketball around, how often do we see ourselves needing this service at the last minute? A demand-constrained tipping point for a fast-growing startup can prove deadly in a highly competitive market.

Smartphone Battery-Pack Sharing

This is the brightest startup idea of them all – we’re talking about portable chargers. The perceived-success of a Shared-Smartphone Battery Pack Startup is selling like hotcakes in China, with five startups in the industry received a combined total funding of RMB 300 million (US$ 43 million). Beijing-based Xiaodian received over RMB 350 million (US$ 51 million) of funding after closing its first financing round from large venture capital firms such as Sequoia Capital and Banyan Capital.

Furthermore, Xiaodian’s competitors, Hidian and Feichangdian, received 100 million yuan and several million yuan respectively on the same day. Additionally, Mobao and supposed market leader, Ankerbox received a 7-digit RMB angel round from a Biauto executive and a 8-digit RMB angel round from IDG and Sunwoda respectively.

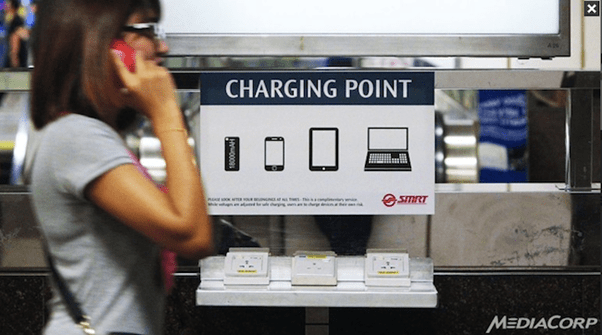

While Mobile Smartphone Charging solutions are not entirely new to China, the situation there is rather similar to that of Singapore’s. In China, there are coin operated charging stations in shopping malls and transportation hubs which eventually become free-of-charge due to the low profit margins (companies monetized through ad-space and advertising services instead).

Charging-as-a-service comes in primarily two business models – one where there are fixed charging stations such as the ones represented by Xiaodian and Singapore Power (SP), and another whereby the company rents you a portable power bank which you can bring along and eventually return to other power stations, represented by Ankerbox and Laidian.

Singapore emulated the same idea and similarly attained little success as these fixed charging stations physically limits the extent to which the charging services can be used. Thus, the biggest flaw in these solutions is that they are not portable in an age where mobility and convenience is highly-coveted. This is where bicycle-sharing companies in Singapore have succeeded, adopting a business model that values mobility and convenience.

Thus, the business model, adopted by Laidian and Ankerbox, faces less inertia and is able to scale much quicker than its fixed-charging station competitors. Furthermore, Ankerbox is not new to this industry as they have brought rentable portable chargers to hundreds of restaurants, bars, and coffee shops in Seattle just last year.

However, these startups will face several fundamental challenges to their cause, especially when smartphone charging is becoming faster with USB-C ports and wireless charging being the norm these days. Furthermore, the capacities of our smartphone batteries are increasing yearly as consumers demand for longer-lasting batteries religiously.

These technological improvements would ironically deem a huge consumer segment for these disruptive innovations obsolete, with the battery-pack rental service becoming more of an “emergency” alternative rather than an everyday need. In Singapore, on top of the free-of-charge charging points stationed at MRT stations and public buses, one can always reach behind the counter of restaurants and concierges for that last-minute juice-boost to last the ride home.

Overall, when the trigger word “Sharing-economy” is involved, the attractiveness of these startups can be better appreciated by venture capitalists riding on the sharing-economy fad, seeking growth and profits. One of the biggest reasons why bicycle-sharing succeeded in Singapore, is that owning a bicycle is a little more costly than one would expect.

At this point, the lack of demand and the challenges posed by longer-lasting battery lives seem to rain on the sharing-economy parade for these startups. These startups are great examples of how the sharing-economy is slowly losing its innovative shine. From the early days of the neighbourly and peer-to-peer sharing-economy that we used to know, the sharing-economy of today is really now just a battleground of prices.